Embracing a dual GH2 strategy: domestic use and trade

01 February 2024

Author(s): Jan Sievernich (UNIDO), Rita Strohmaier (IDOS), Smeeta Fokeer (UNIDO)

01 February 2024

#hydrogen trade

International trade in green hydrogen (GH2) is shaping up to be an attractive endeavour that redraws global energy supply patterns – as such, GH2 producers are pondering strategies for market engagement. The global effort to decarbonize hard-to-abate industries relies on the involvement of developing countries with abundant renewable resources, while industrialized countries remain the demand centres for hydrogen imports. IRENA projects global GH2 production to reach approximately 492 million metric tonnes by 2050, of which around 25% is expected to be traded internationally. But opportunities for GH2-producing countries of the global South go beyond the benefits of direct export.

Trade opportunities and barriers

Exporting GH2 and Power-to-X (PtX) derivatives can fuel economic development. The projected interregional trade of GH2 is projected to reach USD 280 billion in 2050, with over half of its revenues estimated to be generated in developing countries.2 By participating in international energy markets, countries can attract foreign investment exceeding the amount required for local decarbonization efforts. This can lead to a cascade of economic benefits, including increased foreign exchange earnings, tax revenues and local economic activity. However, tax exemptions granted to investors (who are typically permitted to operate in special economic zones) curtail the host country’s tax revenues.

Exports can not only enhance the trade balance but also empower countries within the global energy framework, increasing autonomy and political significance3. International GH2 trade may also facilitate knowledge transfer, accelerating socioeconomic development in exporting countries. Most potential export countries will depend heavily on imports of industrial equipment, which may considerably reduce net export revenues. Nonetheless, the overall expansion of technological capabilities enhances domestic research, development, and innovation.4

Despite ambitious goals, the growth of the international GH2 market has been slow so far, with less than 100 kilotonnes of electrolysis-produced hydrogen in 2022 – far below the projected 2050 demand.5 International transport – especially maritime – of GH2 faces technological and regulatory uncertainties, significantly raising landed costs for the 45% of trade volume that likely won’t be able to rely on pipelines.6 The uncertainty in the scale and dynamics of GH2 trade, coupled with considerations of self-sufficiency and blue hydrogen as a transitional technology in industrialized economies, poses challenges to prospective GH2 exporters.

Strategic state of play

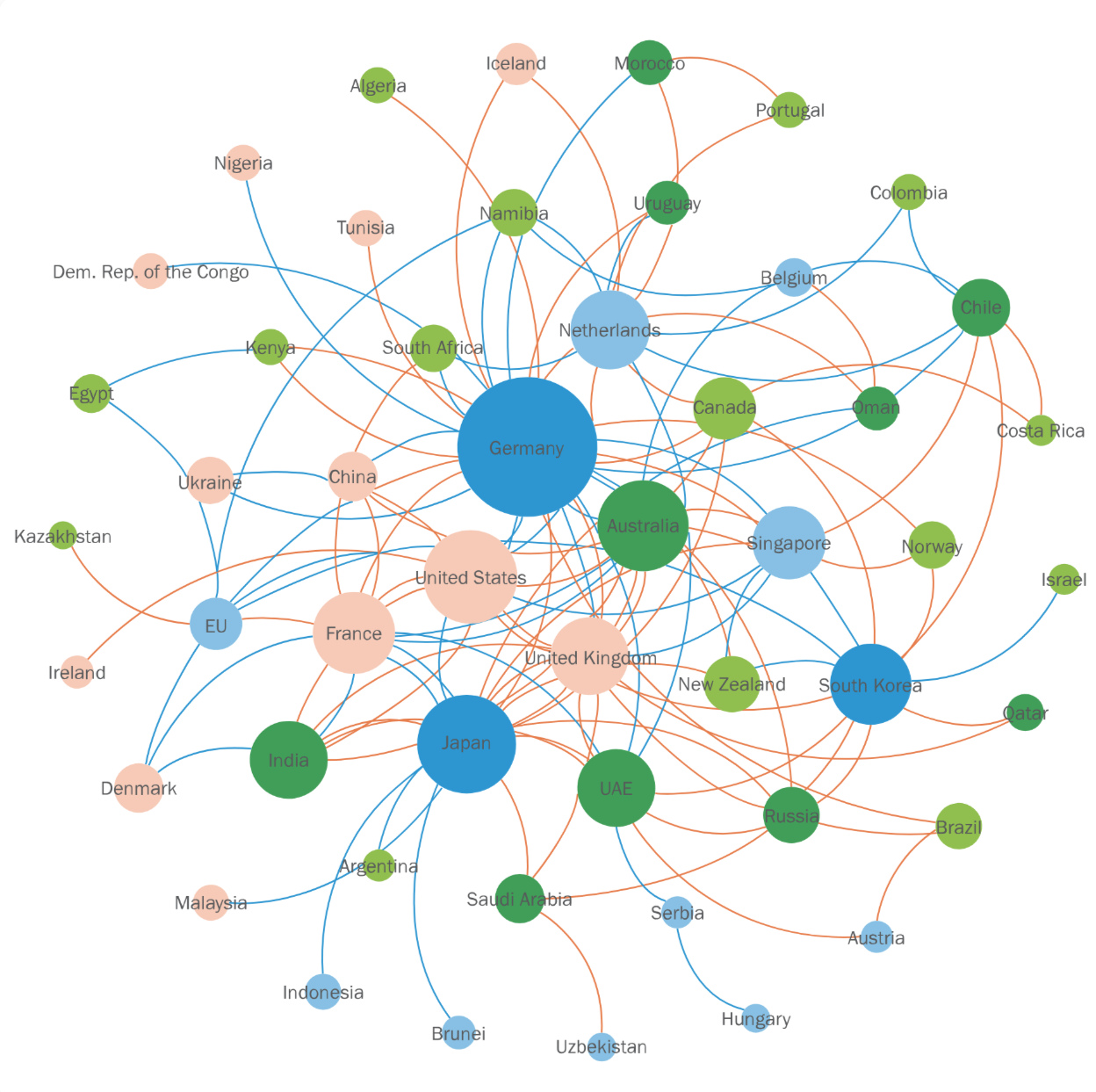

Realizing the pivotal role they can play in the emerging GH2 market, many developing countries have enshrined trade objectives in their national hydrogen strategies. In most cases, these strategies declare a country’s intent to export, import or achieve self-sufficiency, shaping their global market role and collaboration aspirations. Some governments identify specific regions for promoting trade partnerships between prospective importers and exporters as part of their GH2 strategy. International cooperation will be crucial to laying the groundwork for GH2 trade and local benefits through knowledge exchange, technology transfer, collaboration in hydrogen technology R&D, as well as international standard-setting. The figure below displays the current global hydrogen partnership network.

Visualization of the global hydrogen partnership network

Source: Analysis based on data from the World Energy Council Germany (2023), World Energy Council (2022, p.7), and own research. Green shades refer to (slightly and strongly) export-oriented countries, blue shades to (slightly/strongly) import-oriented countries, while light red colour indicates a neutral or rather self-sufficient position of countries.

Some countries prioritize exports, foreign direct investment (FDI), and the implementation of large-scale hydrogen projects in their national hydrogen strategies. Due to the absence of developed hydrogen transport infrastructure, however, countries more often prioritize the development of their domestic markets before entering global hydrogen trade. They adopt a gradual and sequenced approach to GH2 production and use, starting with small- to medium-scale projects on both the supply and demand sides. Certain nations identify “no-regret” applications that are easily adaptable to GH2, such as ammonia production or methanol for feedstock and synthetic fuels.

This vision for GH2 as a catalyst for low-carbon industrial development is increasingly reflected in national hydrogen strategies. This underscores the potential for new sustainable industries employing GH2 locally, such as green steel or fertilizer production. Green intermediates f(e.g. direct reduced iron) , or green goods (e.g. green steel or fertilizer), can provide cheap and sustainable alternatives for international buyers, while accumulating more added value domestically than could be achieved through direct GH2 export. Competitive clean energy prices may even exert a “renewables pull effect”, enticing hard-to-abate industries to set up shop in GH2 producer countries.7 Additionally, some nations aim for a competitive edge and leadership role in upstream hydrogen technologies, including electrolysers and fuel cells.

The dual approach

The dual approach to hydrogen utilization seeks to maximize the domestic benefits of producer countries by engaging in both direct export and local use. As with any other natural resource, a strategy based on export is easier than one that seeks to add value at the national level as it is a quick win with immediate impact on GDP, without the complexity of altering the industry structure. In the short term, then, a purely export-oriented strategy may be more profitable, but it forgoes the longer-term benefits of building domestic skills and shifting away from an old, inflexible industry structure. A dual approach, in which only surplus GH2 is exported, is therefore more beneficial overall.

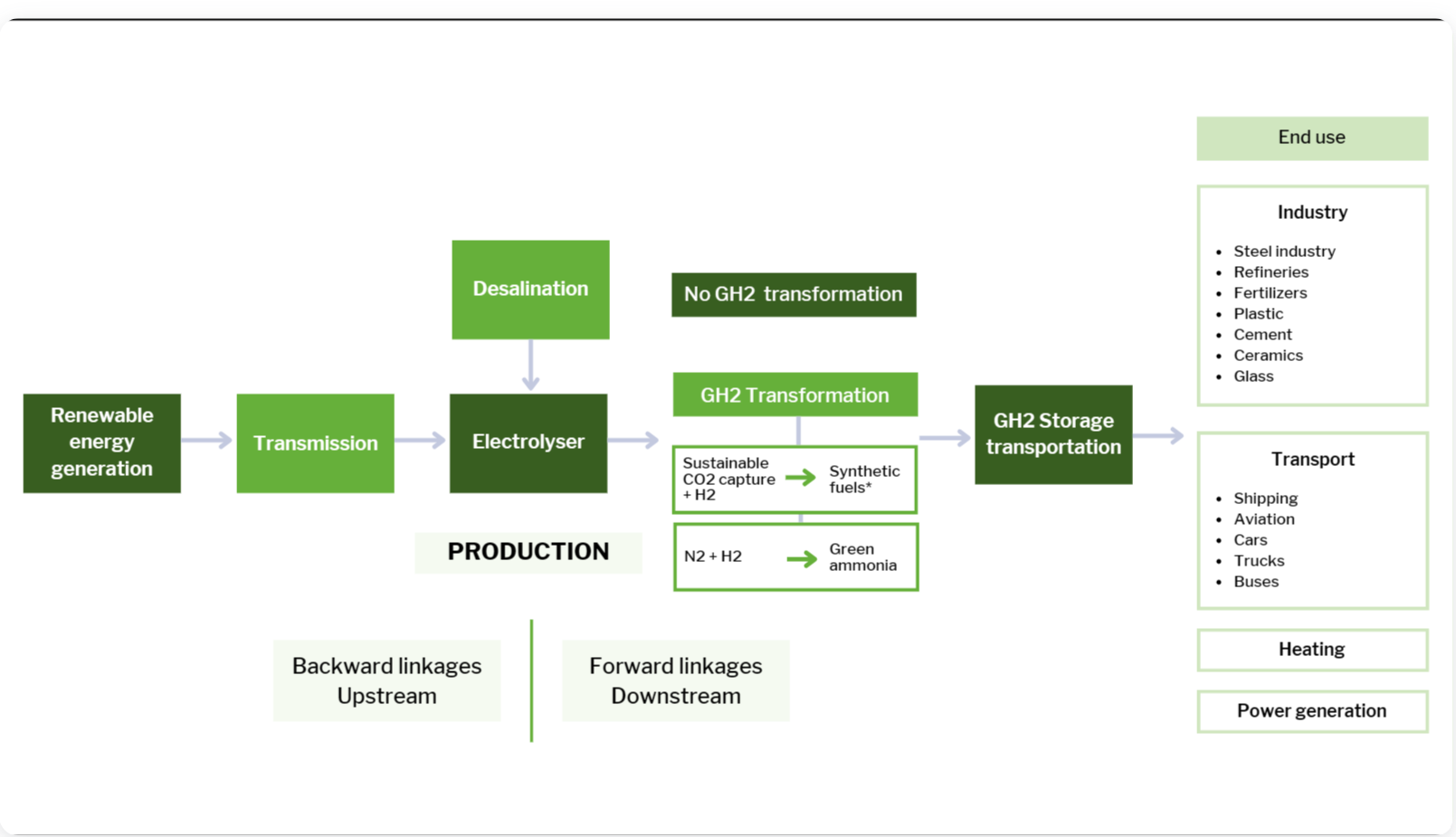

Domestic value creation, industrial linkages, technological learning and permanent employment are more likely to be achieved when GH2 is produced for local uses (i.e. for decarbonizing the domestic economy and promoting green industrialization). The more value addition is realized domestically (e.g. by using GH2 to produce green steel or fertilizer, see next figure), the more long-lasting the economic benefits that producer countries can reap. The ease with which this can be achieved, however, depends on the existing industrial structure. If downstream GH2-ready industries are not yet in place, changing the industrial structure to include them will be a complex endeavour, taking years to accomplish. Nonetheless, the benefits are significant: an increased share of manufacturing contribution to GDP, skills development and long-term employment, as well as a more adaptable and flexible industry structure, bolstered by green diversification and the renewables pull effect.

The Green Hydrogen Value Chain

Conclusion

Instead of relying exclusively on GH2 exports, which entail high technological and systemic uncertainties, countries should consider pursuing a dual GH2 trade strategy. This involves the establishment of a domestic hydrogen market to decarbonize existing industries, and exporting any surplus to overseas markets. While more complex than simply exporting GH2 – especially for those within pipeline range of high-demand markets – a local value chain offers extensive long-term benefits. Governments can start by attracting investment in energy-intensive steel or base chemicals, gradually moving into downstream industries that use green steel or chemical feedstock, and upstream into industries that produce renewable power generators and electrolysers. This long-term vision calls for a careful alignment of the country’s energy, infrastructure, trade and industrial strategies.

- Source: The article was published on the IAP UNIDO website.