The trend is clear: green hydrogen will be a key element of the future global economy. Governments, industry and other stakeholders need to adapt their industrial development strategies to the new framework conditions. This is a challenging task and calls for multi-stakeholder strategies5.

Adapting industrial development strategies to the new framework conditions can help countries reap early mover advantages.

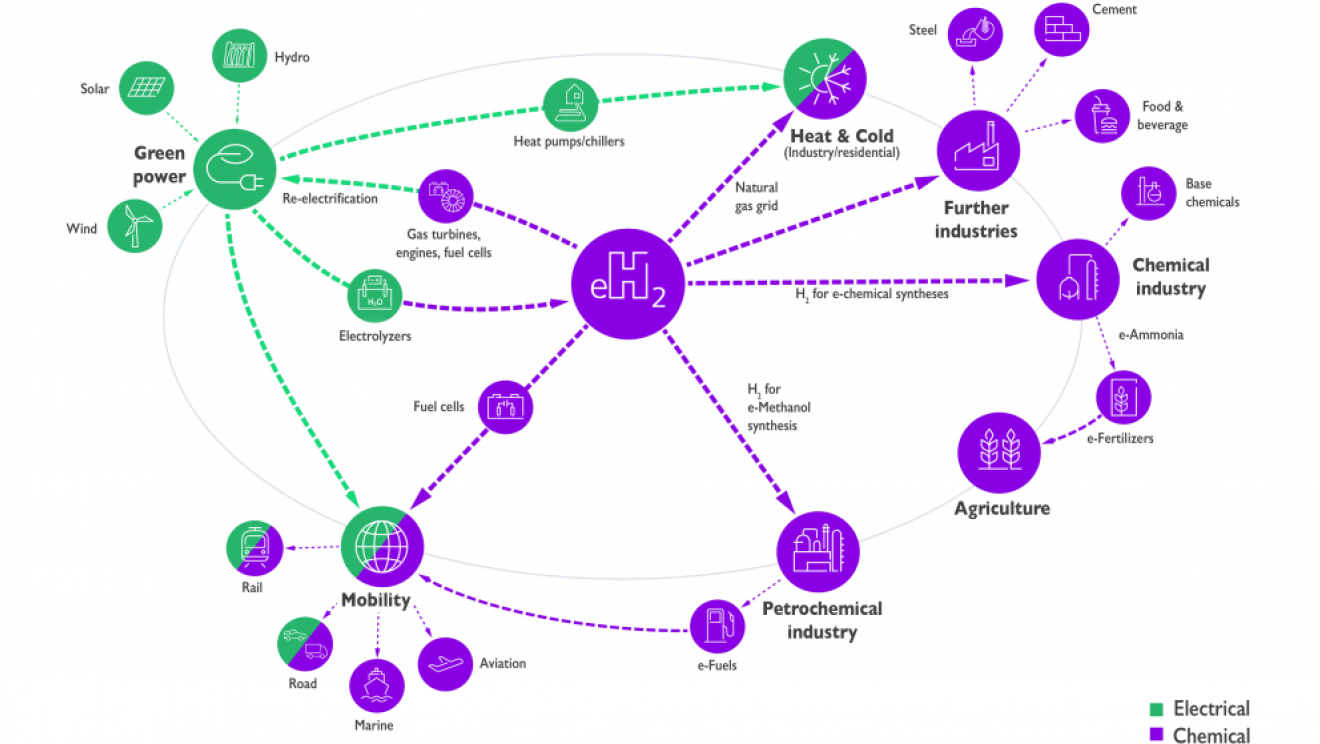

Societal stakeholders need to determine which of the different industrial pathways outlined above can be exploited in line with their factor endowments, geographical advantages and technological capabilities. Each pathway requires different investments in renewables, electrolysers, grids, ports and pipelines. Taking the right decisions is particularly difficult given the uncertainty associated with prices and technologies. Demand for green hydrogen depends on a range of political decisions in major economies: on the level of carbon prices, support for renewable energy deployment, acceptance of alternatives, such as carbon capture and storage and nuclear energy, willingness to adopt protectionist measures, as well as geopolitical considerations of energy security. All of these factors can either accelerate or slow down demand. Moreover, green hydrogen deployment depends on complementary large-scale investments in new technologies, for example tankships, thereby generating uncertainty about transport options and costs. For a country to successfully exploit renewable energy and green hydrogen to attract energy-intensive industries, a wide variety of factors affecting the choice of location for such industries must be considered, from inter-industry linkages and availability of a qualified workforce to investment climate issues. Finally, safeguards are needed to ensure that green hydrogen industry development does not exacerbate existing water scarcity or land use conflicts. That is, a range of new regulations must be adopted, and countries need to join international initiatives to develop common safety and environmental standards.

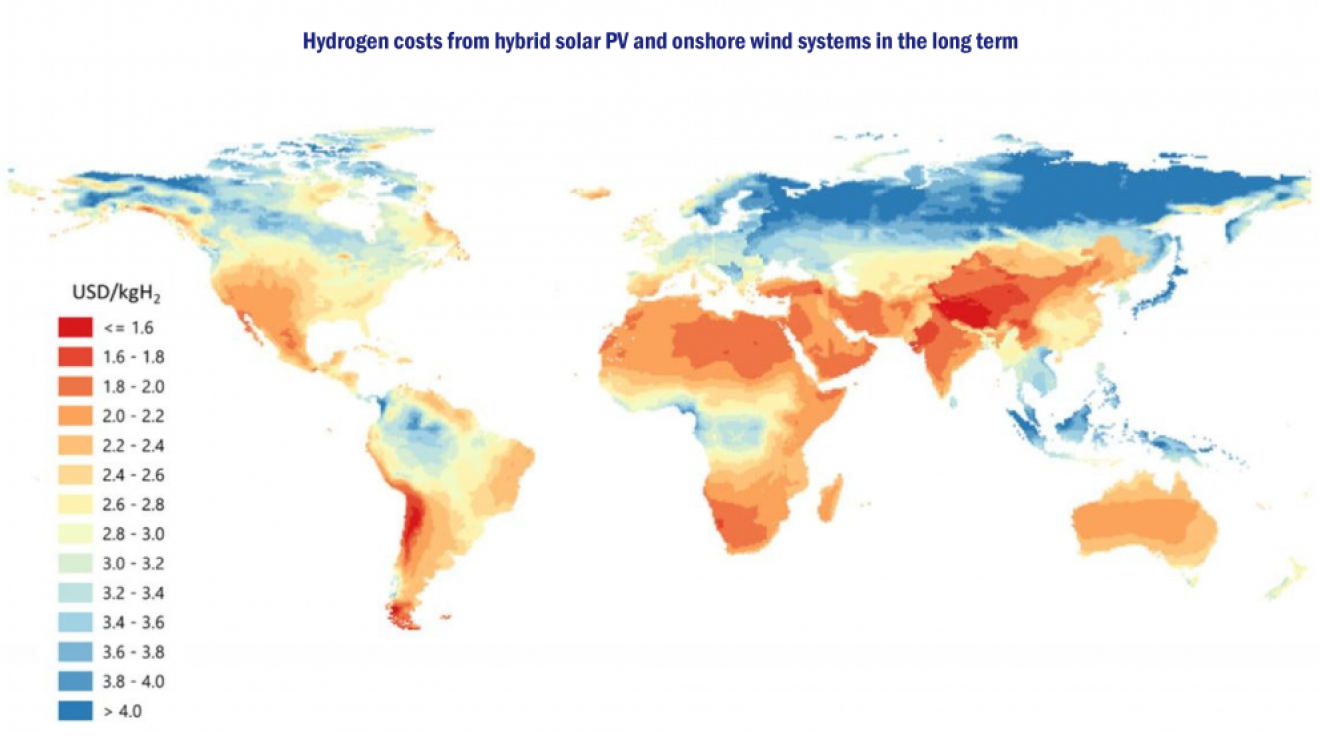

An increasing number of countries are developing green hydrogen roadmaps and strategies. Most industrialized countries will be net importers of green hydrogen. Their strategies aim to decarbonize their industries, secure the import of green hydrogen, shield their industries from unfair competition from countries with less ambitious decarbonization policies, and exploit early mover advantages. Some countries – Australia, for example – are home to energy-intensive industries and plentiful renewable power sources. Those countries are particularly well-positioned to reap early mover advantages in green hydrogen.

Green hydrogen is a promising export option for many developing countries. These countries usually have smaller domestic industries and demand for green hydrogen is therefore lower, but many of the countries are endowed with abundant renewable energy resources. An increasing number of potential exporters are also developing green hydrogen strategies, including Chile, Uruguay, South Africa, Brazil, Saudi Arabia, Ukraine, Turkey, Viet Nam and Morocco6. The strategic choice here is whether to envisage green hydrogen as a new export commodity (corresponding to our channels 1 and 2) or as a stepping stone towards a diversified and knowledge-based economy (channels 3 and 4). In the first scenario, countries well-endowed with solar, wind and other renewable power resources will need to encourage investments in energy parks, electrolysers and related feedstock as well as the required export infrastructure, including pipelines and ports. Such investments, if well-managed, can boost export revenues; yet they tend to be capital-intensive, with very limited effects in terms of employment creation and technological learning. In the second scenario, low-cost renewable power and green hydrogen are taken by governments as the basis for creating industrial clusters and value chains with higher value added. Other countries such as South Africa and Brazil have already settled on a hybrid option by engaging in both pathways.

Under these premises, irrespective of whether they are renewable energy rich or poor, countries need to proactively adapt their industrial strategies now to anticipate what the increasing global adoption of green hydrogen will imply for their industrial development in the coming decade. Green hydrogen is here to stay and no country wants to be left behind.

An adapted article has also been published on the Sustainable Global Supply Chains Network.

- Manuel Albaladejo is Country Representative for Argentina, Chile, Paraguay and Uruguay, at the United Nations Industrial Development Organization (UNIDO).

- Tilman Altenburg is Head of the Department of Transformation of Economic and Social Systems at the German Development Institute.

- Smeeta Fokeer is Industrial Development Officer at the Climate and Technology Partnership Division (CTP) of the United Nations Industrial Development Organization (UNIDO).

- Nele Wenck is Junior Specialist at the United Nations Industrial Development Organization (UNIDO) and PhD student at Imperial College London.

- Petra Schwager is Chief of the Energy Technologies and Industrial Applications Division at the United Nations Industrial Development Organization (UNIDO).

Disclaimer: The views expressed in this article are those of the authors based on their experience and on prior research and do not necessarily reflect the views of UNIDO (read more).